Reach The Finer Things In Life: Build Your Ladder To Financial Freedom

If you’ve ever had the privilege of picking fruit fresh from the tree, you know that the biggest and tastiest morsels are often located in the very upper-most, hardest-to-reach branches.

While frustrating, this should come as no great surprise given the abundance of fresh air and sunlight available at the top of each tree. Reaching this fruit requires both determination and, in most cases, a ladder. But the juicy reward makes the effort expended well worth it.

Just like grade-A fruit, financial freedom doesn’t always come easy. Obtaining it requires both intentionality and the right tools. With this in mind, today we’re reviewing how to build a savings goal ladder rung-by-rung that will enable you to obtain financial freedom and reach the finer things in life.

Table of Contents

Are You Settling For Life’s Low-Hanging Fruit?

Food on the table. A roof over your head. A job that pays decent wages. A car that gets you to work and back fairly reliably. Relatively good health. While these are certainly things to appreciate and be thankful for if you have them, they represent the low-hanging fruit in life.

Maslow’s hierarchy of needs is often illustrated as a pyramid containing five distinct “levels” of human needs and motivation. Needs such as food, shelter, health, and security all fit in the most basic two categories found at the bottom of this pyramid. Adequate food, housing, transportation, and employment are all prerequisites to achieving the higher levels of social acceptance, esteem, and self-actualization.

Yet many in modern society fail to climb beyond these first two rungs on Maslow’s ladder of human need. In some cases, the effort and energy expended to put food on the table and pay the bills can leave us incapable of finding fulfilling relationships or performing proper self-care when it comes to our physical, mental, or emotional health.

Too often, providing for one’s family comes at the high cost of spending little to no quality time with them. Working a job that pays the bills but leaves you exhausted, lacking in patience and willpower, and merely surviving rather than thriving in your time off the clock will leave you permanently settling for the low-hanging fruit in life.

Once You’ve Tasted The Best, You’ll Want More

But once you’ve climbed to the very top of Maslow’s ladder and tasted the very best that life has to offer, the low-hanging fruit of food, shelter, and security begins to lose its luster. While these things remain important, they cease to become destinations in and of themselves and shift in status to become simply a means unto the pursuit of a greater end.

A Lesson From My Early 20’s

I look back with great fondness on my late teens and early twenties. In this period of my life I was living alone while renting a small house in the country, attending college full-time and working part-time.

I lived close to the vest and earned just enough money to pay my bills. My weekly grocery budget was just $30. I kept the thermostat at 60 degrees in winter, and resorted to using an electric space heater to heat only my 6′ x 8′ bedroom for an entire winter due to the high cost of propane. I became a self-taught mechanic because I couldn’t afford to pay someone else to perform my auto repairs.

Although I didn’t have much in the way of creature comforts or spending money, I had just enough cash to fully cover the base two levels of Maslow’s pyramid. But I also had enough TIME to climb beyond the first two rungs on this ladder, all the way to the top.

Work-Life Properly Balanced

My work and life were properly balanced, leaving me with enough time to establish and maintain meaningful relationships with other like-minded people. I was able to invest and build into other’s lives when they needed someone to talk to or lean on.

I spent plenty of time outdoors and in the healing power of the sun, maintaining the 4 acres I called home. Was able to maintain and improve my health with regular workouts. To invest in hobbies which I enjoyed and found fulfilling. To actually better myself.

In short, I wasn’t just surviving. I was thriving. Living life, rather than letting it live me. I was tasting the choice fruits of the truly fine things in life.

A Painful Fall

Little did I know that this wasn’t to last. After obtaining my degree and starting work full-time, the demands of my job slowly began growing year by year. My work-life balance began shifting out of alignment. I became less patient and more irritable. My health suffered. I found myself constantly behind with my relationships and to-do lists.

My wife and I had plenty of money, but very little time. I was providing financially for my family, but I was MIA when it came to emotional support, as I was seldom home during waking hours. And when I was, it was in the form of a burned out shell of my true self. I was in pure survival mode.

All the while, I chafed at the imbalance in my life. Having once tasted the finer non-material things life has to offer, I was no longer satisfied with the lesser-than fruit from the lower-hanging branches.

Mrs. FFP and I finally decided we’d had enough. We craved a simpler life where we were free to truly live again. We became determined to create a different and better future, and began building a financial freedom ladder that would ultimately enable us to reach the select fruit at the top of life’s tree once more. Here’s the process that worked for us.

A Review Of Savings Goals

Any ladder capable of reaching financial freedom and the truly fine things in life requires individual rungs consisting of savings goals. This concept is important enough that the last six articles in the Master Your Money series have been focused on helping you incorporate savings goals into your financial plan.

We first took a look at how to determine the net profit of your monthly budget, as well as the power of using that net profit to be selfish… with yourself. We then reviewed how those two concepts can help you achieve a savings goal which is the key to beating Murphy’s Law.

We’ve covered how to make your financial freedom shopping list and check the price tags of each of the items on it. And in the last two articles, we reviewed how you can strike it rich by using discretionary income to mine your debt, as well as which debt reduction method is best.

Prioritizing Your Savings Goals

Financial freedom can consist of very different things for different people. By now, you should already know how many savings goals your personal vision of financial freedom requires. Prioritizing these savings goals in the most logical and efficient order prior to beginning construction of your personal ladder to financial freedom is essential.

The first step in doing so is to simply break the savings goals listed on your financial freedom shopping list down into three separate categories – must-haves, want-to-haves, and nice-to-haves. The must-haves will form the first third of your ladder, the want-to-haves will form the second third, and the nice-to-haves the final third.

Within each of these sub-sections you need to prioritize savings goals in the manner that is most mathematically efficient. If the financial implications are negligible, order them by their importance to you and your ideal future lifestyle.

Debt reduction goals should typically always come first, as eliminating debt increases your ability to save for other goals. The results of the neck-and-neck race between debt reduction methods should help you decide in which order to place your debt reduction savings goals.

If you have credit card debt, eliminating it prior to creating an emergency fund may make the most sense. In case of emergency, you can simply put the expense on the credit card balance that you’re already paying down.

If you do not have access to a line of consumer credit, you may be best served to build up a small emergency fund to deal with the effects of Murphy’s Law prior to paying down non-consumer debt like student loans or your mortgage.

Creating Savings Goals In Mint

We’ve discussed the what and the why, now let’s get to the how! Once you’ve defined the optimal order for your savings goals, it’s time to start constructing your ladder to financial freedom. To do so, we will turn to the “Goals” page of your Mint account.

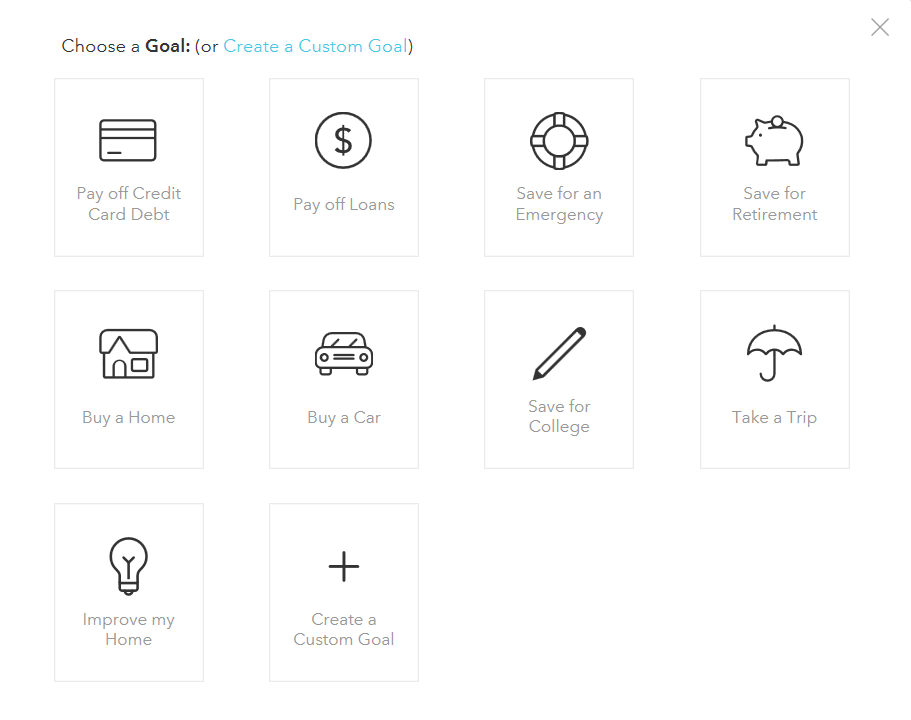

Mint’s Goals feature provides you with the ability to list and visually track your progress on your savings goals. After navigating to the Goals page, you’ll see a button titled “Add A Goal”. Select it and you are presented with the below list of available goal types:

Each of these goal types other than the “Custom Goal” contains a custom setup process tailored to the goal selected. For example, the “Buy a Car” goal type contains setup parameters for things like sales tax, potential car trade-in value, and even a car value lookup option via Kelley Blue Book.

Select & Configure Savings Goal Type

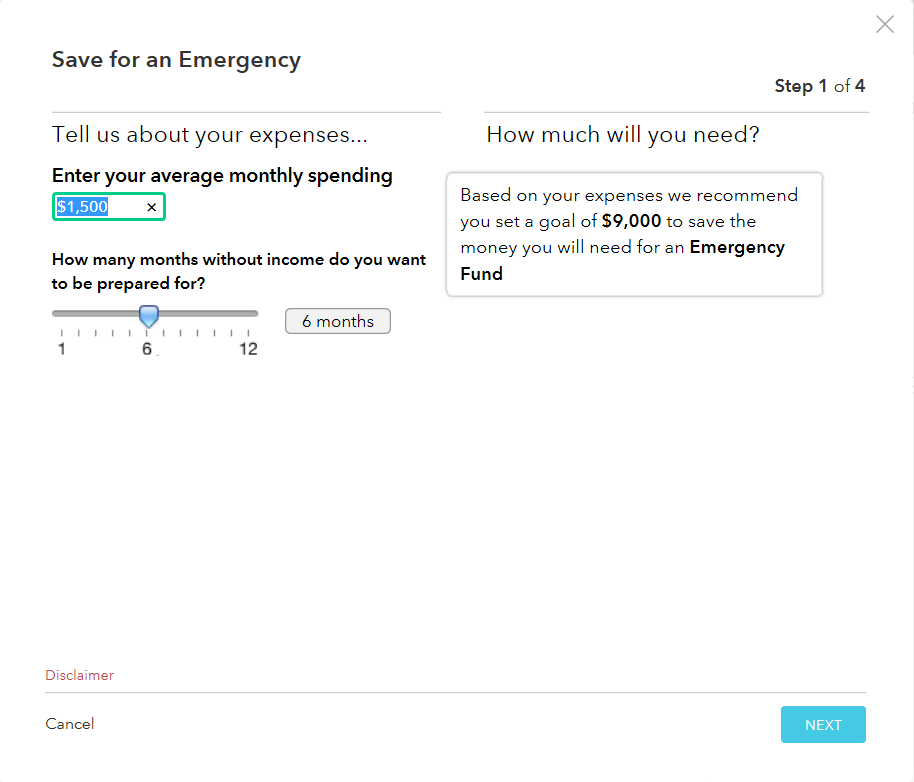

Similarly, the “Save for an Emergency” goal automatically calculates your required balance based on the amount of monthly spending you enter and the desired length of job-loss coverage you desire:

Linking Accounts To Your Savings Goal

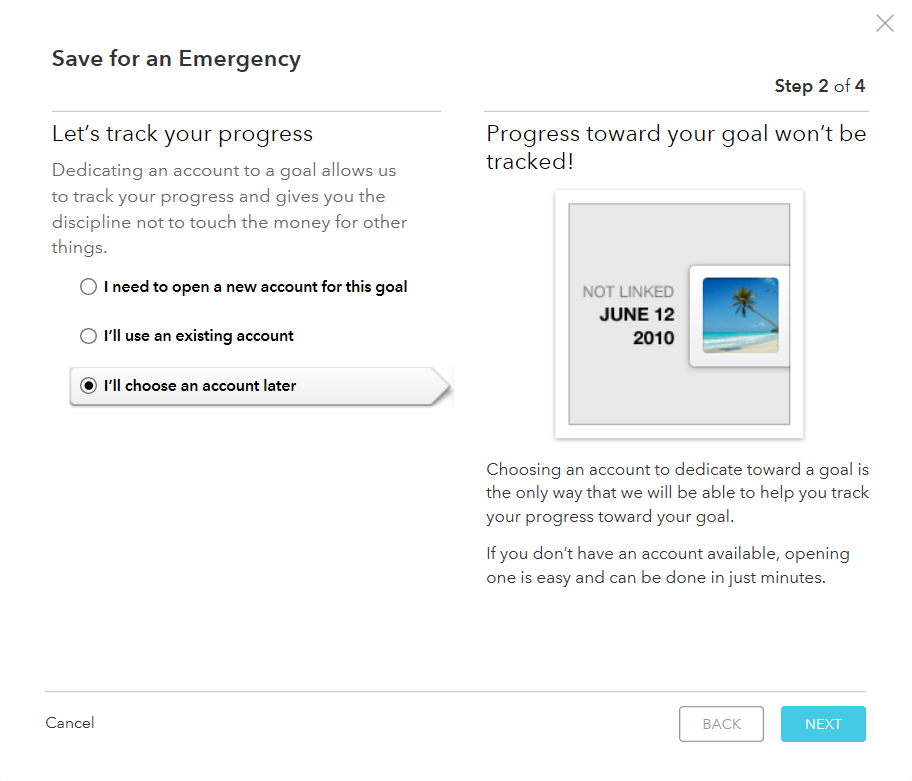

Moving forward with the “Save for an Emergency” example, we find that the next step is to link a specific account to the goal. Doing so enables Mint to track your progress via the accumulated balance in the linked account. We encounter three available options:

Mint is capable of helping you open a new account if needed, per the first selection above. Selecting the second option will present you with a list of all of your accounts, which you can then link to this goal. Be aware that while you can link multiple accounts to one goal, you cannot link multiple goals to one account.

The last option pictured above will defer the linking of the goal to any accounts until a later point in time. This precludes any progress tracking until the goal is linked to one or more accounts, but is handy for setting up multiple goals when only one will be actively saved for at a time. We’ll use this setting for sake of our example.

Determine Target Date & Monthly Savings Amount

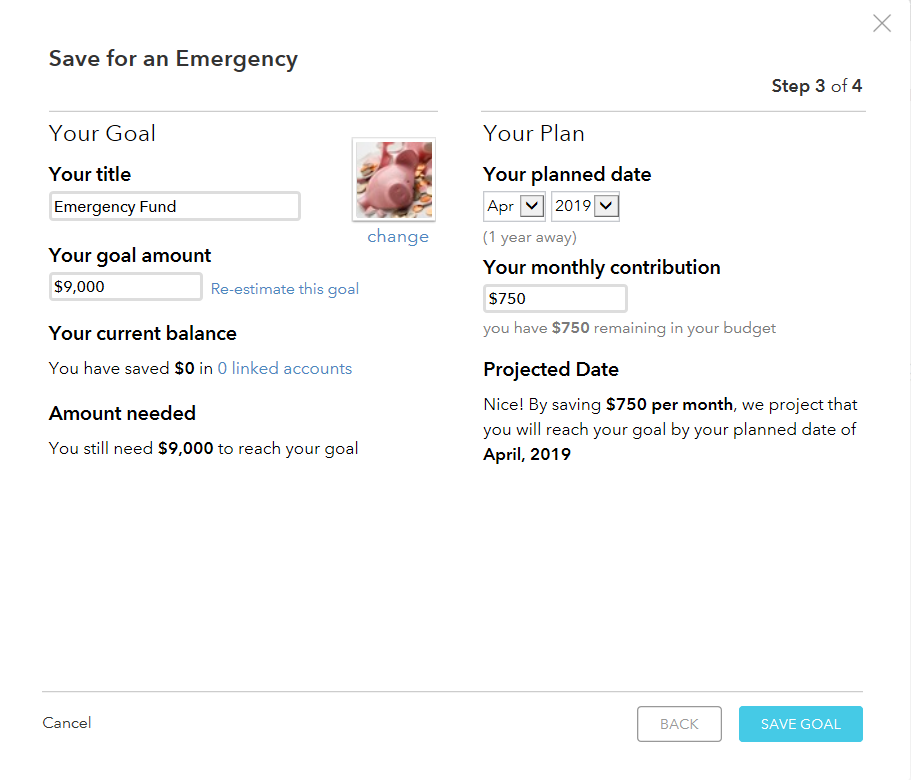

In the next step, you’ll have the option to assign a custom title and photo to your goal if desired. You can also override or re-estimate the desired goal amount. But the most powerful feature of this screen is the relationship between your planned date of completion and monthly contribution:

Note that your planned monthly contribution is informed in the above example by the current surplus of discretionary income in your existing monthly budget.

Note that your planned monthly contribution is informed in the above example by the current surplus of discretionary income in your existing monthly budget.

For those of you who have been following the Master Your Money series from the beginning, your current monthly budget in Mint should only consist of income, bills, and non-discretionary spending. The listed monthly budget surplus should therefore represent your maximum available savings, assuming $0 in discretionary spending.

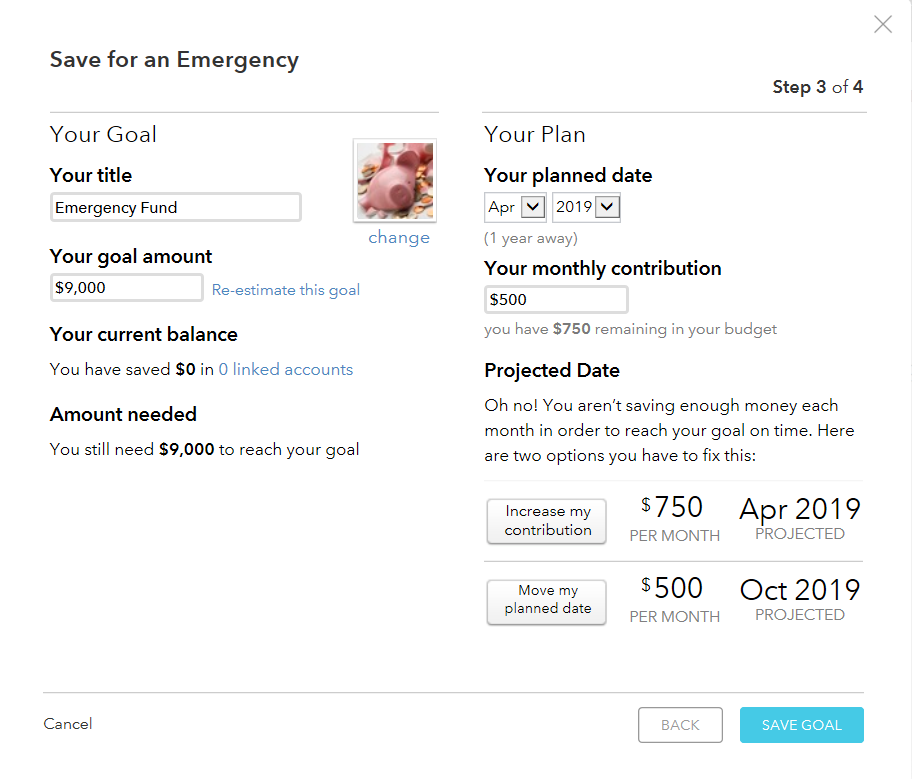

Adjusting your planned completion date will automatically update your required monthly contribution. This enables you to get a feel for a realistic completion date. Conversely, adjusting the monthly contribution amount will provide you with options to either alter your contribution amount to meet the listed planned completion date, or alter the planned completion date:

After experimenting with your completion date and monthly contribution amount parameters, select “Save Goal” to finish setup. You can make your goal public at this point if you so choose, in the name of bolstering accountability:

Savings Goal Summary & Details View

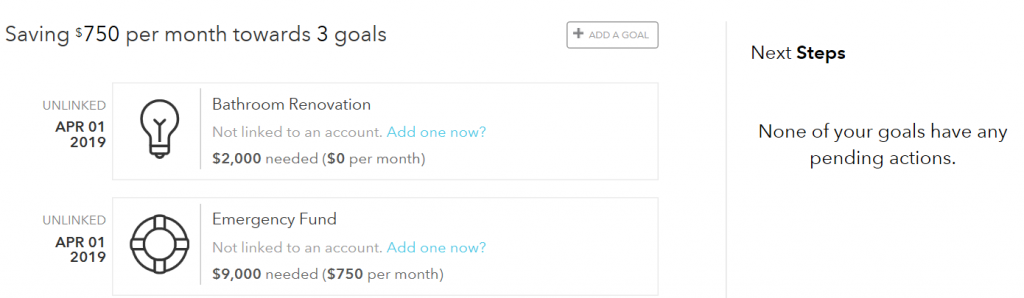

Selecting “Close” will return you to the Goals overview. This displays a summary of all existing goals with projected dates of completion, visual progress bars, information regarding goal progress being ahead or behind schedule (if an account is linked) and any associated action items:

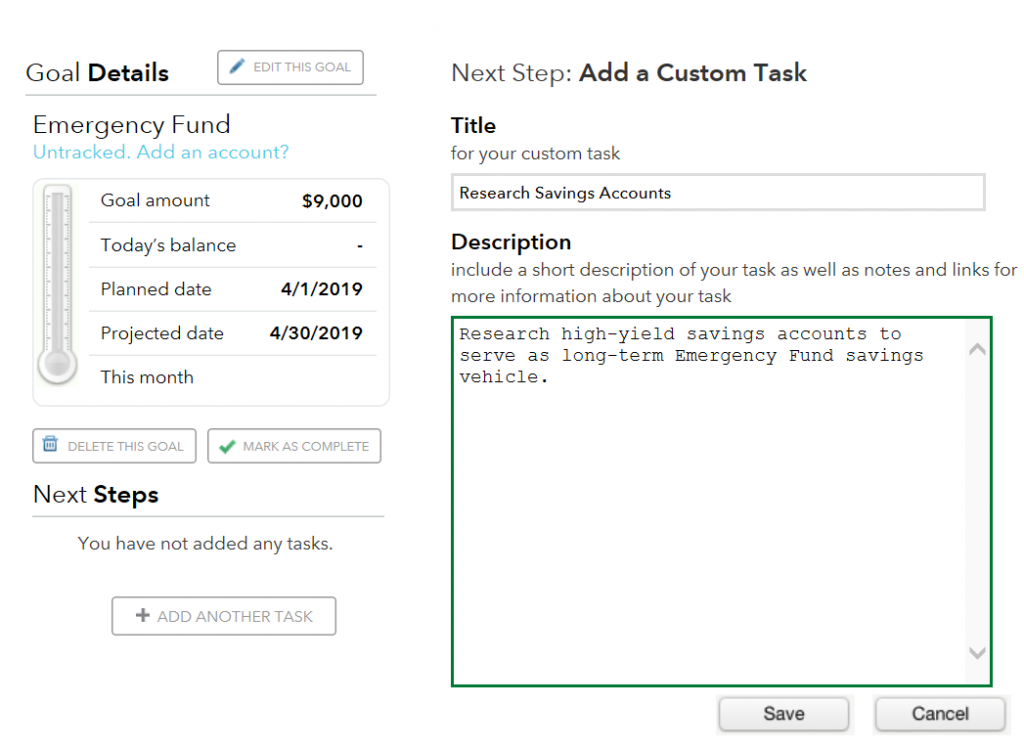

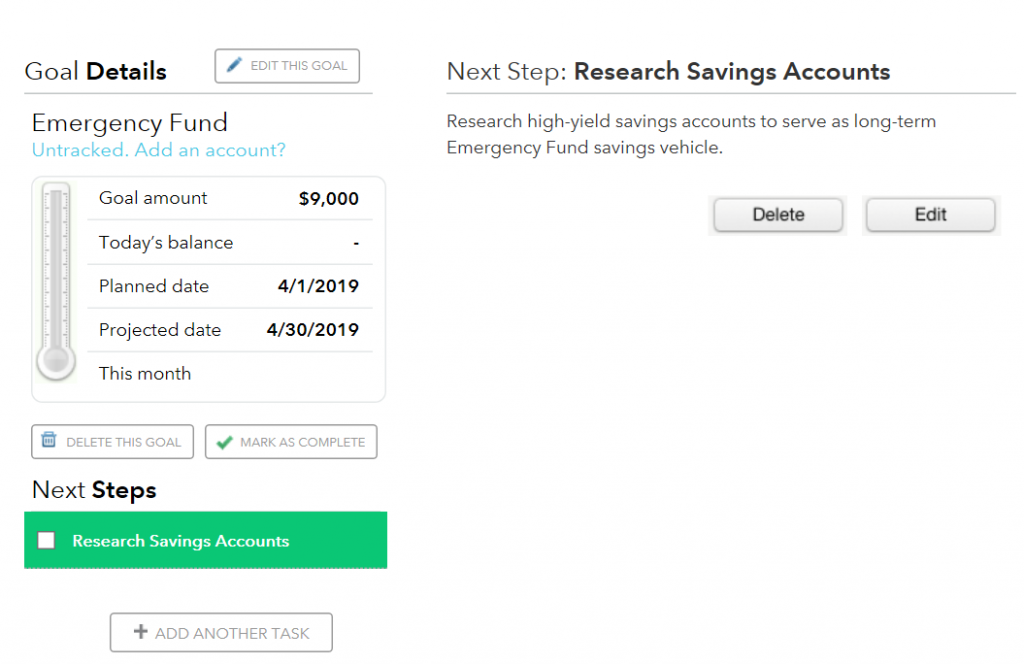

Clicking on a given savings goal will take you to the details overview, where you will have the option to review your projected completion date in relation to your planned completion date, edit, delete, or mark your goal complete, and add custom tasks or action items: Once saved, any tasks or action items added will show as illustrated below, and can be marked complete by ticking the checkbox in the section at the lower left:

Once saved, any tasks or action items added will show as illustrated below, and can be marked complete by ticking the checkbox in the section at the lower left:

Video of Savings Goal Creation Process

The below one minute, 53 second video demonstrates the setup process for creating a credit card debt elimination goal, start-to-finish:

Stop Surviving, Start Thriving

Are you settling for the low-hanging fruit in life? If so, it’s time to realize that there’s more to living than simply knocking yourself out to provide for yourself or your family. Stop merely surviving, and start building your ladder to financial freedom so you can thrive instead.

Mint provides an excellent way to list, monitor, and track your progress on climbing the ladder to financial freedom. Build your savings goal ladder as outlined below and you’ll have the necessary equipment to reach the choicest fruit life can offer.

Building Your Savings Goal Ladder

For those of you who have been following the Master Your Money series from the beginning, below are your next steps on the path to financial freedom:

- Prioritize the savings goals listed on your financial freedom shopping list.

- Use the results of the debt-free derby to prioritize your debt payoff savings goals.

- Create a goal in Mint for each of your savings goals.

- Mint lists goals top to bottom in the order in which they are created.

- If you desire a “to-do” style checklist which will be completed top to bottom, add your most immediate goal first and work to the bottom of your list.

- If you desire a “ladder” style checklist that you ascend with each goal completed per the analogy in this article, do the opposite.

- Enter goal amounts based on the price tags you’ve already checked.

- Use the classic car model to determine the ideal size of your emergency fund.

- Only link goals to accounts which are dedicated for a specific purpose or use. For example, link loan, retirement savings, college savings, or health saving accounts to their related goals. All other savings goals should remain unlinked until you begin actively saving for them.

- Mint does not permit linking accounts to multiple goals, as this results in issues with tracking goal progress.

- An alternative is to open dedicated savings accounts for specific goals. We will be reviewing this process in the near future.

- Set planned completion dates for each goal based on your ideal timeline. You will reconcile completion dates with contribution amounts once you begin actively saving for each goal.

- For all goals linked to loans, set the monthly contribution amount to the minimum payment amount. For all others, set it to $0. You will revisit this once you begin actively saving for each goal.

- Mint lists goals top to bottom in the order in which they are created.

What savings goal is the next rung on your financial freedom ladder? Share in the comments!

I love the ladder metaphor, as well as the low hanging fruit. My husband and I got really serious about our finances about a year and a half ago, and it has changed us so much! Now I feel like I’m happily perusing the top of the pyramid. We use Mint for our money tracking as well, and like it a lot.

Thanks for the kind words, Mrs. SS! As an aspiring horticulturalist with a love for our very own 18 fruit trees, I thought the analogy simply too good to pass up.

It is indeed astounding how liberating it is to have your finances under control, knowing that your spending fully aligns with your values. It’s not known as “financial freedom” for nothing, eh?

It sounds like you and your husband have fully mastered your money bronco. Congratulations!

Mrs. FFP and I have been Mint users for the last 8 years or so, and it is the best free money management tool I’ve found to date. We use Personal Capital as well, but only for net worth and investment tracking, as its money management features are pretty weak compared to Mint’s.