The Debt-Free Derby: Debt Snowball vs. Debt Avalanche

In the last article, we used the story of the American ’49er and the greatest mining boomtown in U.S. history to discover how you can strike it rich by mining your debt.

By the end of that article, you should have been able to identify the size of your personal debt mother lode as well as the potential income and wealth concealed within each of the individual loans on your debt claim.

But in order to calculate how much of these riches you can actually recover, you need to decide which debt reduction method you’ll put your money on and ride to the debt-free finish line.

Today we’re taking a definitive look at the top two thoroughbreds in the debt-free derby to determine which is the better mount for your financial racetrack – Debt Snowball or Debt Avalanche.

Table of Contents

The Debt-Free Derby

The term “derby” has its roots in horse racing. Although placing wagers isn’t our thing, Mrs. FFP and I enjoy following the history and genetics of this historic pastime. For us, the “Sport of Kings” conveys a certain high-brow charm and evokes feelings of nostalgia for the simplicity of a long-ago era. In our family, the Secretariat and National Velvet movies are practically classics.

There are three major annual races on the U.S. thoroughbred horse racing circuit – the Kentucky Derby (1 1/4 miles), the Preakness Stakes (1 3/16 miles), and The Belmont Stakes (1 1/2 miles). If a given racehorse manages to win all three of these races in the same year, it is awarded The Triple Crown.

While the Triple Crown has been in existence for 142 years, only 12 horses have laid claim to the title. Compounding the difficulty of winning three separate races is the fact that each is a different distance. Some racehorses are sprinters who charge hard out of the gate but fade down the backstretch on longer races. Others are slower starters who are outmatched in shorter races but who gain on the field in longer affairs. A thoroughbred who can lead the field in all three of the above races is rare indeed.

Like matching the strengths of a racehorse to the characteristics of a specific track, the approach you use to pay down your debt should be customized to meet your specific circumstances. Will you put your money on the prototypical fast starter, or the determined long-strider who takes the lead on the final straight-away?

The Debt Snowball

The “Debt Snowball” method of debt reduction was first made popular by Dave Ramsey. This approach involves paying down debt starting with the loan that has the smallest balance.

As each loan is paid off, its minimum monthly payment combines with the previous extra payment amount to form a larger extra payment on the loan with the next largest balance. This creates a “snowball effect”, as extra payments continue growing in size with each loan repaid.

Like the American Quarter Horse, the Debt Snowball represents a fast starter. This approach will deliver the fastest increase to the net profit of your monthly budget by paying off your small loans quickly. This frees up cash flow and can be a good fit if that is your immediate need. However, the performance of the Debt Snowball fades down the stretch in longer affairs as the compound interest headwind saps its stamina.

A Debt Snowball Time Trial

Here’s an example. Let’s say a given household has $250 in monthly discretionary income as well as the following two loans:

- Auto Loan – $5,914 balance at 6% interest, $509/month

- Credit Card Debt – $10,955 balance at 16.41%, $383.432/month

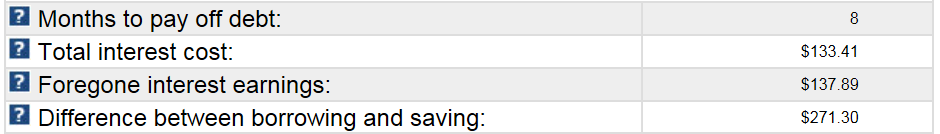

The Debt Snowball method applies extra payments to the loan with the smallest balance first, which in this case is the auto loan. Using a total payment of $759/month ($509 + $250) and a 7% investment rate of return, this cost of debt calculator indicates that this household is able to pay off the loan in 8 months after paying $133.41 in loan interest and $137.89 in foregone interest earnings. Combined, this results in a total opportunity cost of $271.30:

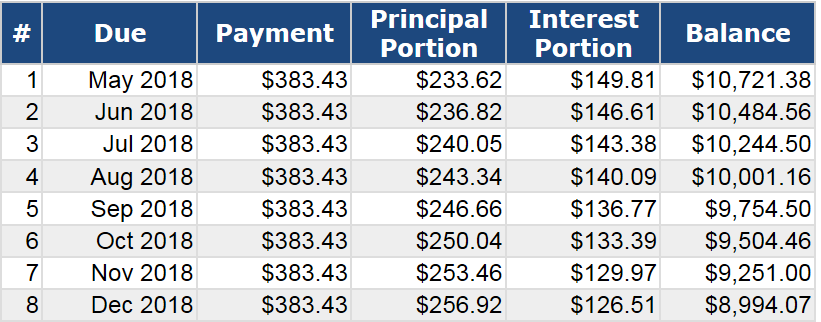

During these 8 months, this household has been making the minimum $383.432/month payments on their $10,955 credit card balance. This credit card payoff calculator illustrates that the 8 regular payments made to the credit card during this span have dropped its balance to $8,994.07:

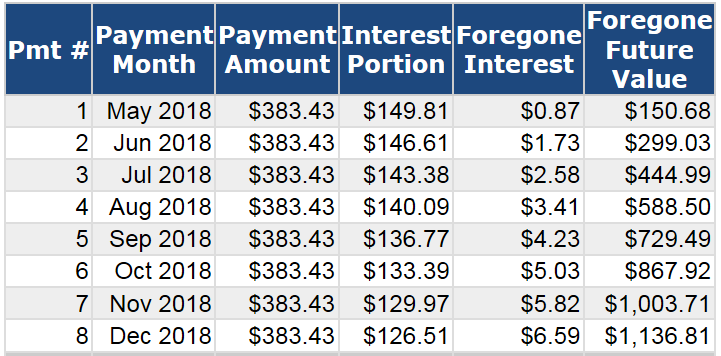

Returning to our handy cost of debt calculator, we find that the combined interest and opportunity cost incurred on the credit card loan over this 8 month span totals $2,243.34 (sum of interest portion column values and last row of foregone future value):

Thus, the status of the debt for our example household after 8 months is as follows:

Auto Loan – $5,914 balance at 6% interest, $509/month- Credit Card – $8,994.07 balance at 16.41%, $383.432/month

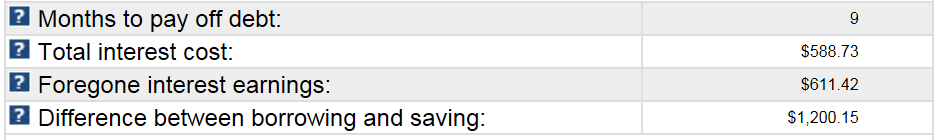

In the absence of the auto loan payment, their previous $250/month in discretionary income becomes $250 + $509 = $759/month. This is now added to the original $383.432 as an extra payment on the $8,994.07 credit card balance. This snowball effect will eliminate the balance in 9 months after another $1,200.15 in combined interest and opportunity costs:

This household will therefore become debt-free in 17 months after paying a total of $3,714.79 in combined interest and opportunity cost:

- Auto Loan – $271.30

- Credit Card – $2,243.34 (first 8 months) + $1,200.15 (next 9 months)

The Debt Avalanche

The “Debt Avalanche” approach involves paying down debt starting with the loan that has the highest interest rate. As each debt is paid off, its minimum monthly payment combines with the previous extra payment amount to make a larger extra payment on the loan with the next highest interest rate.

This utilizes the same “snowball effect” as does the Debt Snowball, but does so in a more mathematically efficient manner by targeting your highest interest rate debt first.

Like the Arabian Horse, the Debt Avalanche represents a long-strider. Unlike the Debt Snowball, this approach will not necessarily deliver the fastest increase to the net profit of your monthly budget out of the gate, as the loan with the highest interest rate could potentially possess a large balance and take some time to pay off. This could be a disadvantage if quickly increasing your discretionary income is your primary goal.

The advantage of the Debt Avalanche lies in longer distances. If given enough time, this approach quickly builds speed and will catch the flagging Debt Snowball down the stretch as it is running the optimal path to the debt-free finish line, tight to the rail.

A Debt Avalanche Time Trial

The Debt Avalanche approach applies extra payments to the loan with the highest interest rate first, regardless of balance. Let’s see how this compares to our earlier Debt Snowball scenario. Our sample household has the same $250 in monthly discretionary income and the same two loans:

- Auto Loan – $5,914 balance at 6% interest, $509/month

- Credit Card Debt – $10,955 balance at 16.41%, $383.432/month

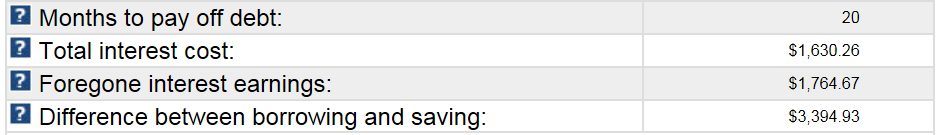

Of the two loans, the credit card has the highest interest rate. By throwing an extra $250/month at their credit card in addition to the $383.432 required minimum payment, our cost of debt calculator indicates that this household is able to pay off the loan in 20 months after paying $3,394.93 in combined interest and opportunity cost:

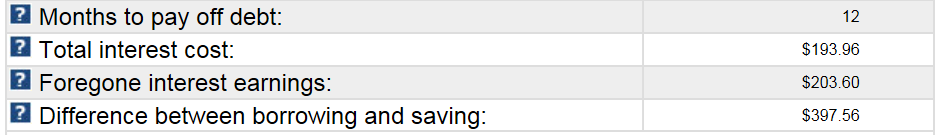

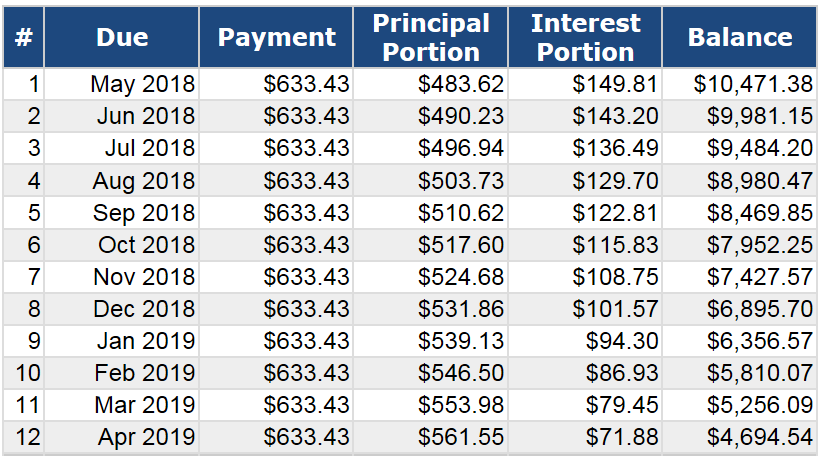

But we can’t forget that the auto loan will be paid off after just 12 months of minimum payments:

This means the discretionary income available for extra payments on the credit card will have increased after 12 months. The credit card balance after 12 months is $4,694.54:

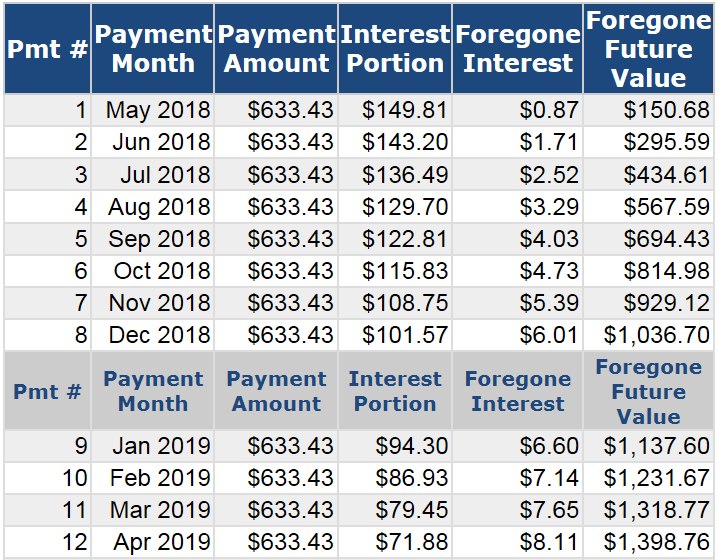

And the combined interest and opportunity cost paid on the credit card over this 12-month span is $2,739.48:

Thus, the status of the debt for our example household after 12 months is as follows:

Auto Loan – $5,914 balance at 6% interest, $509/month- Credit Card – $4,694.54 balance at 16.41%, $383.432/month

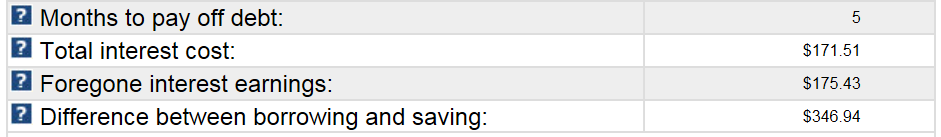

Due to the absence of the auto loan payment after 12 months, this household can afford to put another $509 towards the credit card payment each month. This accelerates the payoff timeline for the remaining $4,694.54 balance to just another 5 months, accompanied by $346.04 in interest and opportunity cost:

This household will therefore become debt-free in 17 months after paying a total of $3,483.92 in combined interest and opportunity cost:

- Auto Loan – $397.56

- Credit Card – $2,739.42 (first 12 months) + $346.94 (next 5 months)

A Head-To-Head Race

Comparing the results of the two time trials, we find that the Debt Snowball paid off both loans in 17 months after a total of $3,714.79 in combined loan interest and associated opportunity cost. Meanwhile, the Debt Avalanche also paid off both loans in 17 months but after a total of only $3,483.92 in combined loan interest and opportunity cost.

As advertised, the Debt Snowball was a fast starter out of the gate. It posted a first lap time that was four months faster than the Debt Avalanche, paying off the first loan in just eight months.

But the Debt Avalanche hit its stride down the stretch and made up ground by sticking tight to the rail and taking an optimal path around the compound interest track. While both mounts crossed the debt-free finish line at seventeen months total, the Debt Avalanche edged the Debt Snowball when it came to total loan cost.

The Debt Avalanche was therefore the better mount overall, resulting in $230.87 (6.2%) less in total loan interest and opportunity cost paid. While this isn’t much in the way of a winner’s cup, this amount can grow quickly as debt balances, interest rates, and time horizons increase.

Race Results In Review

In most cases, the Debt Snowball will increase your monthly net profit most quickly. This gives you cash flow flexibility and the morale boost of seeing the number of your loans dropping. But it comes at the price of knowing you’re paying a penalty of sorts (6.2%, in this case) by not tackling your highest interest rate debt first.

The Debt Avalanche may not free up your discretionary income as quickly if your high interest rate loans have large balances. However, it is the more mathematically efficient approach, and will save you the most money overall in the form of loan interest and opportunity cost. It is best for disciplined individuals who can play the long game, knowing the odds are on their side.

Neither mount is a guaranteed winner on every single track or in every financial situation, as each have their individual strengths and weaknesses which make them better suited for some circumstances than others. You may even find that the winning strategy for your personal financial racetrack may be putting your money on different horses as your debt-free derby progresses.

For example, riding the rapid acceleration of the Debt Snowball to pay off one or two small loans and quickly build the net profit of your monthly budget prior to taking advantage of the endurance and long-track speed of the Debt Avalanche for your larger loans may prove the best blend of speed and endurance for your personal racetrack.

Selecting Your Ideal Debt Reduction Mount

For those of you who have been following this Master Your Money series from the beginning, below are the next steps on your journey to financial freedom:

- Use the current monthly net profit of your budget in combination with this cost of debt calculator, this credit card payoff calculator, and both of the debt reduction methods outlined in this article to determine how quickly you could pay off all of your debt, as well as how much money you could save in the process.

- You’ll need to know the interest rate, current balance, and monthly payment for each loan, which will all be available within Mint.

- Compare your debt-free date and the opportunity cost total for each method to one another as well as to the results of making no extra payments whatsoever.

- This online tool makes comparing the results of the Debt Snowball and the Debt Avalanche both intuitive and visual, although it only accounts for loan interest and doesn’t include opportunity cost calculations.

- Compare the results and discuss the pros and cons of the Debt Snowball and Debt Avalanche debt reduction methods with your significant other, if you have one. Determine which of these two approaches makes the most sense for your particular circumstances in light of your findings in step #1. Remember that a hybrid approach may suit your situation best!

Extra Bonus – The sport of horse racing is filled with creative names for racehorses. After completing the action items above, assign a creative and meaningful name to your debt reduction strategy. And don’t forget to tune in to the Triple Crown races this May and June!

I recently compared these two methods also recently, with some charts showing the payoff progress. Hope you don’t mind me sharing. https://maximizeyourmoney.com/debt/crush-debt-snowball/