About

Hello, reader! Welcome to The Financial Freedom Project, a blog dedicated to making financial freedom, financial independence, and early retirement attainable for other everyday people with everyday incomes.

Driven to pursue financial freedom, but don’t have a six-figure income and don’t want to live like a hermit? That’s alright, I didn’t either. The good news is that there is another way.

This is Mr. Financial Freedom Project (Mr. FFP, for short), founder and author of this site. Below you’ll find a synopsis of our story, the blog, and what you can expect to find here moving forward.

While I encourage you to read through this page start-to-finish to gain the best understanding of what this blog is all about and determine whether it’s for you, I’ve included an expandable table of contents below which contains links to each subsection in case you’re short on time.

Table of Contents

Our Story – Cliff Notes Edition

Prior to getting married, Mrs. FFP and I both shared a desire to own our own home, start a family, and raise that family with one parent in the home full-time. We knew accomplishing all three of these things on just an average household income was going to be tough. So after getting married, we created a plan that would enable us to achieve all three of our dreams.

We bought a house we could afford, lived significantly below our means, and saved tens of thousands of dollars in interest by paying off the mortgage in just 3 years and 2 months, start-to-finish. We accomplished this in large part by simply being intentional with our finances, which enabled us to make nearly quadruple payments with our approximately average household income.

According to plan, my wife then “retired” from the workforce to become a stay-at-home wife and mother as we downsized to a single income in order to start a family.

When the work-life balance of my job became a major issue shortly after, we began pursuing financial independence in support of waving goodbye to the need for a paycheck forever.

In order to speed our journey, I became an avid scholar of the subject and devoured every book and blog on the topic I could find. A natural optimizer, I researched, developed, and implemented many detailed strategies while building a comprehensive financial plan that enabled us to save aggressively on a median income while still living a life of relative luxury.

After a total of just 10 years in the workforce, the dream became a reality. Free of the stress and burden of 70, 80, and even 90-hour work weeks, I now dedicate my time to family, relationships, healthy living, and passion projects such as this blog.

You can read more about who we are as well as our journey to financial independence at this link, while you can read about the blog and my vision for it below.

If We Achieved Financial Independence by 30, You Can Too

One of the primary motivations behind this blog is to share with other everyday people the financial attitudes, tactics, and strategies which enabled my wife and I to pay off our mortgage in our mid-20’s and become financially independent by the age of 30 on no more than an average income.

No worries – there will be no mandatory diet of rice and beans on the menu, and I won’t be asking you to make your own laundry detergent or toothpaste. Promise!

Despite what the pundits would have you believe, it is possible for people of modest means to not only achieve incredible financial goals, but to do so while living well at the same time.

What Exactly Is Financial Freedom?

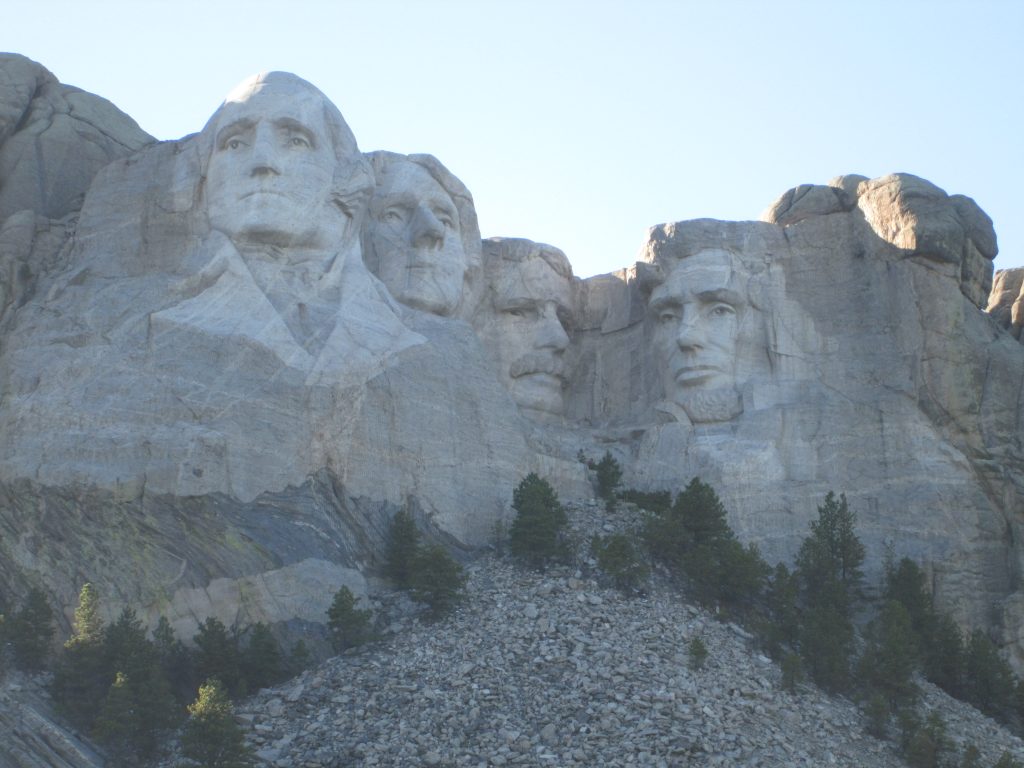

So what exactly is this financial freedom I speak of? Hard-and-fast definitions vary widely, but my personal definition can be found in photo format within the header of this website.

In written form, I define financial freedom as possessing the ability to live a fulfilling and passionate life free of significant limitations imposed by either stress regarding money or a lack of money itself. That said, I submit to you that the definition is flexible and should be determined by your own financial goals.

For example, some individuals may define financial freedom as simply eliminating the stress of overdrawn bank accounts, maxed out credit cards, and living paycheck to paycheck. A few months’ worth of living expenses in savings may be enough to give them all the financial freedom they desire.

Others may define it as the relief of no longer having monthly bills arrive in the mail for credit cards or other consumer debt. For yet others, paying off the mortgage, saving for their children’s college education, affording to travel, or giving generously to family, friends, and charity represent their concept of becoming financially free.

Some may have a desire live on only one income so a spouse can remain at home while raising a family. Entrepreneurial souls may define financial freedom as the ability to quit their day job in order to start up their own business. Yet others have a desire to leave a stressful job they don’t enjoy for a job which pays less but is much more fulfilling.

The truly independent spirits amongst us (myself included) define financial freedom as the holy grail of achieving financial independence (a.k.a. FI), the point at which one no longer needs to work for money to cover living expenses.

Is This Blog For You?

If you find yourself living paycheck-to-paycheck, feel as if your money is controlling you, or simply get stressed about money, then this blog is definitely for you. If you can identify on some level with any of those three statements, it’s high time to take charge of your money situation so that you can live life on YOUR terms, for a change. I look forward to helping you do that presto, stat, and posthaste!

Maybe you’re in a slightly better financial situation but are still unable to live the life you’re passionate about due to a lack of money. For example, maybe you’d like to change jobs, but feel trapped because your family is relying on your current benefit package. Perhaps you’d like to start a family, but aren’t certain you can afford it. Or perhaps you’d like to start up your own business and don’t feel comfortable quitting your job and taking the leap of faith due to a lack of savings. If any of these describe your situation, I look forward to equipping you with the information and tools you need to surmount these barriers.

If you are already on a journey to financial independence and would like the perspective of someone who has compiled a highly-optimized personal game plan which is intended to both achieve and support FI on a modest level of income and which spans topics such as investment vehicles, withdrawal strategies, health care, taxes, social security and estate planning, then I believe you will feel right at home here as well.

What Type Of Content Will Be Featured Here?

This blog is intended to serve as a full-spectrum guide to personal finance. That means that in addition to outlining detailed money management and savings hacks, this blog will also cover topics such as income tax reduction strategies, investing, applications of the do-it-yourself concept of insourcing, and early retirement withdrawal strategies.

You will also find a smattering of minimalism, environmental responsibility, and green living topics that emerge from time to time, when and where they intersect the core principles of financial freedom.

The underlying theme connecting each individual strategy discussed here will be that of planning for financial independence, the top rung on the financial freedom ladder.

Financial achievements of this magnitude by the rank and file require comprehensive financial plans which take the proverbial path less traveled to press further and deeper than many other conventional strategies in the search for the highest possible level of optimization and efficiency.

This blog is predicated on rising to that challenge and leaving no stone unturned within the personal finance field in support of charting a detailed, optimized, full-spectrum path to financial freedom and independence for those who can only get there by pulling out all the stops due to average or even below-average income levels.

How Will The Financial Freedom Project Differ From Other Personal Finance Blogs?

There are many other excellent personal finance blogs already in existence which have done and continue to do an admirable job of pioneering and covering financial freedom, financial independence, and early retirement topics and concepts. Specifically, I credit Mr. Money Mustache, the Mad Fientist, and Can I Retire Yet? for serving as influences on and resources for my own journey to financial freedom.

I believe The Financial Freedom Project will be somewhat unique inasmuch that many existing blogs in the financial independence realm document the journeys of dual-income couples who often possessed annual household income well above six-figures during their wealth accumulation years.

I feel that this frequent common denominator has somewhat contributed to an (incorrect) perception amongst the media, general populace, and potentially even the online community that financial freedom, financial independence, and early retirement can only be achieved in one of two ways:

1) Possessing a household income nearly double the U.S. national average of $57,617/year.

2) Eating spam while living in a tent mumbling comforting mantras such as I-wish-I-was-warm while scrimping and saving, penny-by-penny.

My goal is to combat this perception by inspiring everyday individuals possessing modest incomes with the knowledge that not only can they too achieve full financial independence early in life, but with the right plan of attack they can do so while still living a comfortable lifestyle.

Summary

Too often I have seen friends, family, co-workers, and acquaintances who stress over or are otherwise limited by money in their ability to lead a free and fulfilling life. Based on my own experience, I firmly believe that a savvy financial game plan is all that is needed to provide most individuals in our society with the freedom to live the life of their choosing.

That is ultimately why I’m starting this blog. I was blessed with the opportunity to learn much while studying, developing, and charting my own family’s course to financial independence. TFFP represents my desire to share what I’ve learned with others to inspire, inform, and equip them with the financial knowledge and tools they need to live the life they desire as well.

The specific purpose of this blog is three-fold:

1) Eliminate money as a barrier and source of stress in your life by showing you how to master your money.

2) Expand your metaphorical horizon by opening your eyes to the rewarding and fulfilling lifestyle that it is possible to lead in modern society on a median income or less.

3) Inform and equip you with the knowledge and tools necessary to achieve your personal vision of financial freedom – up to and including financial independence, defined as no longer depending on wages to cover living expenses.

Master Your Money. Expand Your Horizons. Pursue Your Dreams.

Join the community here at The Financial Freedom Project!