Go Green & Save: The Benefits Of Paperless Billing & Banking

Saving money often goes hand-in-hand with conserving the environment. Upgrade your home’s energy efficiency, drive a more fuel efficient vehicle, or practice minimalism, and you’ll save both cash and natural resources.

The intersection of green living and personal finance is one of my favorite topics. For those of us who are hard-wired to pursue efficiency and optimization, this combination is as irresistible as a colorful flower beckoning to a butterfly.

The crossover between these two pursuits is exemplified perhaps nowhere better than by paperless billing and banking. Like twin flowers in a field, going paperless offers dual benefits – the opportunity to save money and reduce your environmental footprint at the same time.

Table of Contents

What Is Paperless Billing & Banking?

I’ve already covered how you can de-stress, save up to $130,000, and preserve the planet with online bill pay. But how you pay a bill represents only one half of the bill pay equation – how you receive it is just as important.

Paperless billing consists of bills that are sent to you electronically rather than through the mail. In some cases, these bills are sent as an attachment directly to an email. In others, particularly for bills containing sensitive information, emails are sent stating a bill is available via the secure website of a given service provider.

Paperless banking works virtually the same way, although in regard to bank statements rather than bills.

Financial Benefits Of Paperless Billing & Banking

Paperless billing and banking is now offered by many service providers and banks. You can save time and money while protecting your identity by enrolling. Let’s take a closer look at the various ways you can do so below.

Extend Your Billing Grace Period

We’ve already covered how paying your bills online effectively extends your personal grace period by eliminating mail handling and delivery time-frames. Similarly, you can give yourself more time to budget for and pay a given bill if you receive it electronically.

Paperless bills bypass the time it takes your service provider to print, fold, and mail your bill, to say nothing of the time it spends in transit. For example, this USPS map tool indicates that First Class Mail can take as long as three business days to make it to all areas of the continental United States. Weekends and Federal holidays only extend this time-frame further. The near-instant delivery of a paperless bill via email offers a clear advantage here.

If you’ve deployed Mint’s bill pay safety net, you’ll automatically be notified of the amount and due date of each new bill as soon as it becomes available. But if you haven’t, a paperless bill will provide you with bill amount and due date information earlier than will a paper version.

Paperless bills also allow you to keep tabs on your financial obligations while away from home on business or vacation.

Identify Low Balances & Fraud More Quickly

The time savings of going paperless applies to bank statements as well. If you’ve opened the door to financial freedom with online banking, you already have 24/7 access to your current balance and transaction history. This is a huge improvement over “going dark” between paper statements and not knowing exactly where your account stands.

If you haven’t yet harnessed the power of online banking, paperless statements will make you aware of low balances, unauthorized charges, or fees more quickly than paper statements. This can help you prevent overdraft fees, contest unauthorized charges, and report potential instances of identity theft more quickly.

Paperless bills give you the earliest possible notice regarding upcoming expenses. And paperless statements provide you with a snapshot of your current balance much faster than a paper statement. Enrolling in both will give you a leg up when designing your monthly cash flow choreography.

Protect Your Identity By Going Paperless

Paper versions of bills and bank statements change many hands prior to you opening them at the kitchen table. This provides ample opportunities for unauthorized access, up to and including identity theft. And the danger doesn’t stop there. After you’re done paying that bill or reviewing that statement, how consistent are you at ensuring it gets shredded? Paper bills or statements left unshredded pose a security concern long after you’ve discarded them.

Conversely, paperless bills and statements are only ever seen by you. Sensitive and personally identifying information contained in bills or statements is usually only available by logging in to the secure website of your service provider or bank.

Paperless Billing Discounts

The benefits of paperless billing aren’t limited to just the consumer. The need for less manual processing, printing, and mailing also benefits businesses. Because of this, many businesses offer customer incentives to enroll in paperless billing.

In some cases, businesses offer financial discounts on products or services for customers who’ve enrolled in paperless billing. For example, we receive a 1.2% discount on our annual auto insurance premium simply for receiving bills electronically.

Some companies pass on the higher overhead costs of paper bills to the consumer in the form of a surcharge. One of our utility providers just started doing this via a $1.00 charge for each paper bill delivered.

This combination of discounts and avoided surcharges enable Mrs. FFP and I to save $20/year thanks to paperless billing. This may not seem like much, but if an 18-year-old high school grad saved this same $20/year and invested it, they would have $9,289.06 by retirement at age 68 based on the inflation-adjusted 7% average rate of return of the U.S. stock market over the last 100 years.

Thanks to the compound interest rocket to riches, the savings of that graduate would more than double to $19,889.84 by age 79, the current American life expectancy.

Paperless Statement Savings

Preparing and sending paperless statements involves far less overhead for banks than paper statements do. Because of this, many banks offer incentives to enroll in paperless banking. This may take the form of waiving minimum balance requirements or account maintenance fees. Some banks simply pass on their higher overhead for preparing paper statements in the form of a paper statement fee.

For example, my local robber baron of a bank charges an additional $4 monthly service fee for accounts receiving paper statements. They also require a minimum checking account balance of $2,500 to avoid a monthly service fee, compared to just $100 for customers enrolled in paperless statements.

Vanguard, the king of low-cost investing, offers another good example. Vanguard waives the $20/year account maintenance fee for customers who have enrolled in paperless statements.

We save $104 every year thanks to the incentives offered for enrolling in paperless statements at our banks. Returning to the high school grad example from above, an annual investment of $104 will grow into a lump sum of $48,302.29 by retirement at age 68 and into $103,425.57 by the current American life expectancy of 79.

Environmental Benefits Of Paperless Billing & Banking

The 2016 Household Diary Study conducted by the USPS found that the average household received 8.9 bills per month by mail (page 46). Collectively, Americans received 13.4 billion bills and 3.9 billion statements through the Postal Service in 2016 (page 43). All told, bills and statements constitute 42% of all paper mail!

A fascinating and informative study titled The Environmental Impact Of Mail: A Baseline found that the typical microwave results in about 15 kg of CO2 output per year, the equivalent of approximately 600 letters sent by mail (page 18). This means the annual total of paper bills received per household has a carbon footprint equivalent to 2.1 months of typical microwave use.

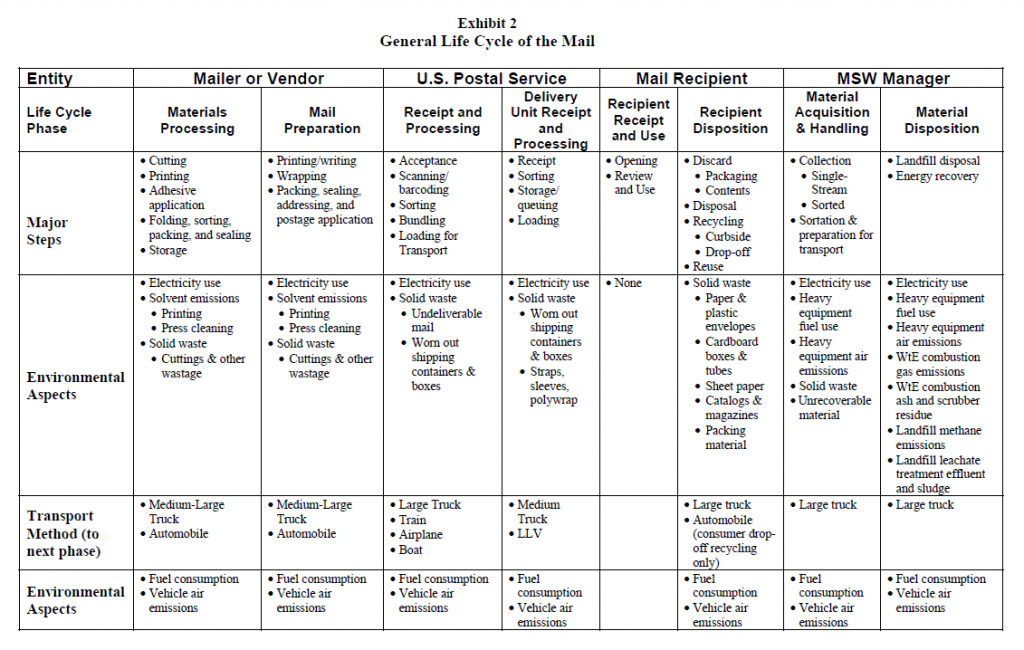

To get a feel for the environmental implications of the mail delivery process that can be avoided with paperless billing and banking, check out Exhibit 2 on page 10 of the 2008 USPS report titled The Environmental Impacts Of The Mail:

Source: “The Environmental Impacts of the Mail: Initial Life Cycle Inventory Model and Analysis” by SLS Consulting, Inc. / USPS

Identify Your Environmental Footprint

Reuters highlighted a 2008 study commissioned by the PayItGreen Alliance which found that by switching to electronic bills, statements and payments, the average American household could save 6.6 pounds of paper, 0.08 trees, 24 square feet of forest, 63 gallons of water, and 4.5 gallons of fuel per year. Not hard to imagine given the process illustrated above!

You can identify the environmental impact of your own paper bills, statements, and payments by using this Financial Paper Footprint calculator (located at the bottom right of page).

The environmental impact of your paper bills and statements may seem like just one insignificant drop in a very large bucket. But if just 20% of U.S. households committed to online bill pay and enrolled in paperless billing and banking, the collective environmental impact is staggering:

- 1.8 million trees preserved per year

- 2 million tons of greenhouse gas eliminated per year

- 102.4 million fewer gallons of gasoline consumed per year

- 151 million fewer pounds of paper consumed per year

Plant-A-Tree Incentives

Some paperless billing customer incentives take the form of plant-a-tree programs. For example, a property management software provider named Entrata has committed to plant a tree for each resident who opts out of paper bills for a paperless bill instead.

By participating in incentive programs like that offered by Entrata, you could indirectly assist with reforestation efforts worldwide and offset some of your own environmental footprint.

According to the Arbor Day Foundation, one tree is capable of absorbing approximately 10 pounds of polluted air each year and producing 260 pounds of oxygen.

The Convenience Factor

Set aside for a moment the money management benefits, identity theft protection, financial incentives, and the ability to reduce your environmental footprint. Paperless billing and banking are simply far more convenient than the alternatives.

Think about it. Less physical mail to sort, open, shred, and dispose of. No need to maintain hard copy filing systems. No need to scan documents to store them digitally. The ability to download and analyze transactions digitally via spreadsheet. Less clutter. Less time.

You can read your paperless bills or statements while on the go, rather than stashing a mountain of paper bills on the kitchen table which you can only peruse while at home. This becomes even more important when you’re away on business or vacation. No more worrying about missing a paper bill or statement – you can access them as they arrive in your email.

Become A Better Steward

Enrolling in paperless billing and banking can extend your bill pay grace period, help you avoid overdraft fees and identity theft, and declutter your kitchen table or home office.

Going paperless allows us to save $124/year, a sum which can total $123,315.41 over the typical American adult lifespan if invested at historical rates of return. Your potential savings may be even higher.

Paperless billing and banking also gives you an opportunity to reduce your household’s impact on deforestation, water and fossil fuel consumption, and greenhouse gas emissions with minimal effort.

The bottom line is that paperless billing and banking provide each of us with an opportunity to become better stewards of our time, money, and environment. This is one of those rare win-win-win situations – if enough of us take advantage of it, the legacy we leave behind for future generations will be rich in more ways than one.

Extra Bonus – Did you know that a single mature tree can produce enough oxygen in a year for two people? Or that studies have shown the presence of trees actually lowers crime rates? Check out this link for some other neat facts about trees. And if you’d like to support or become involved with tree planting and reforestation efforts, check out the non-profit Arbor Day Foundation.

Next Steps

For those of you who have been following the Master Your Money series from the beginning, below are the next steps on your journey to financial freedom:

- Use this Financial Paper Footprint calculator (located at the bottom right of page) to estimate the environmental impact of your paper bills, statements, and bill payments.

- Check with each of your service providers to see whether they offer paperless billing incentives. Oftentimes these can be found on your paper bill or on the provider’s website.

- Check your bank fee schedule to determine if you are being charged a paper statement fee or if any perks are offered for enrolling in paperless statements.

- Tally up the annual savings available from all paperless billing and banking incentives. Then calculate your potential lifetime savings using this compound interest calculator with a 7% rate of return and the difference between your age and your life expectancy.

- Enroll in paperless billing and banking with each of your service providers and banks.

- If paperless billing discounts lowered your monthly bills, update your related budget categories and any related sinking fund transfers, then re-balance your monthly budget.

Great post! Very well thought out and thorough in your analysis. Keep up the excellent work!

Thanks for the kind words, Mr. GoGreenDollar! As a data junkie, I found the USPS studies on the environmental impact of mail delivery quite fascinating.

One look at the mail delivery process as outlined in the General Life Cycle Of The Mail photo above makes it easy to understand how going paperless can save time, money, and the planet.

But paperless billing and banking is only the tip of the iceberg when it comes to saving money while also reducing our collective environmental footprint. I plan on devoting quite a few keyboard strokes to covering other strategies for doing so once I wrap up the current Master Your Money series.

Thanks for stopping by! I love your website and look forward to following your new content.

My son is doing his part in going green by going solar. He is finding it more economical. For me I do everything paperless so much easier. The real savings is on postage by doing all bills on line.

That’s fantastic, Mark! I’m looking at a solar installation myself, but I’m afraid it’ll have to come after my whole house re-plumbing and HVAC project.

I agree, the ease of paperless is hard to beat. And I concur regarding postage savings. If you haven’t already, you might be interested in reading my sister article on online bill pay – De-stress, Save $130,000, & Preserve The Planet With Online Bill Pay.

Based on the average American’s 14 bills per month, I calculated that savings via checks, stamps, envelopes, and return address labels alone can easily total $145.30/year. If invested over the typical adult lifespan, that comes to $130,200.

That beats my personal savings from going paperless, which totals $124.00/year or $123,315.51 over the typical adult lifespan, but not by much. Thanks for stopping by!

I’ve been missing out! I don’t get any kind of financial perk for going paperless, dang it.

What?!? You mean to tell me our Midwestern banks and service providers are more progressive than those of the Pacific NW? Heresy!

At least you can rest easy knowing you’re doing your part by saving 6.6 pounds of paper, 0.08 trees, 24 square feet of forest, 63 gallons of water, and 4.5 gallons of fuel per year. And there’s always the financial savings from online bill pay which you can still claim as well 🙂

I always take advantage of the paperless billing when they offer me something (like the vanguard example). However, I am less likely to sign up for it when they just ask! I figure if they are saving money they should at least pass some of it the savings!

Financial incentives are indeed nice! But even when none are offered, I still consider paperless billing and banking a win due to the environmental savings and the convenience factor.

Great article. Excellent explanation about the benefits of paperless billing banking. Thanks for sharing such an informative article.

Thanks, Lukas! I knew we were saving time, money, and the environment via our utilization of paperless billing and banking here in the FFP household, but was still quite surprised at just how much of each is at stake for the average household once I ran the numbers.