Compound Interest, Part 2: Your Rocket To Riches

This is the second installment of a 5-part series examining the massive impact compound interest can have on your journey to financial freedom.

In part one of this series, we reviewed the phenomenal nature of compound interest, its life-changing potential, and a basic illustration of how it actually works.

Today’s article will illustrate how compound interest can become a rocket capable of breaking the sound millionaire barrier and launching your financial freedom into orbit.

Skeptical? Read on!

The Compound Interest Rocket

The last article left us with an example of compound interest producing a single penny of interest more than simple (non-compounding) interest after a period of two years.

You might not even consider a penny worth stooping to pick up in a parking lot. So why is compound interest such a big deal?

Because when coupled with longer time horizons, higher interest rates, and larger balances, compound interest growth literally accelerates like a rocket leaving the last weakening vestiges of Earth’s gravity, as demonstrated below.

Stage One – The Impact Of Time

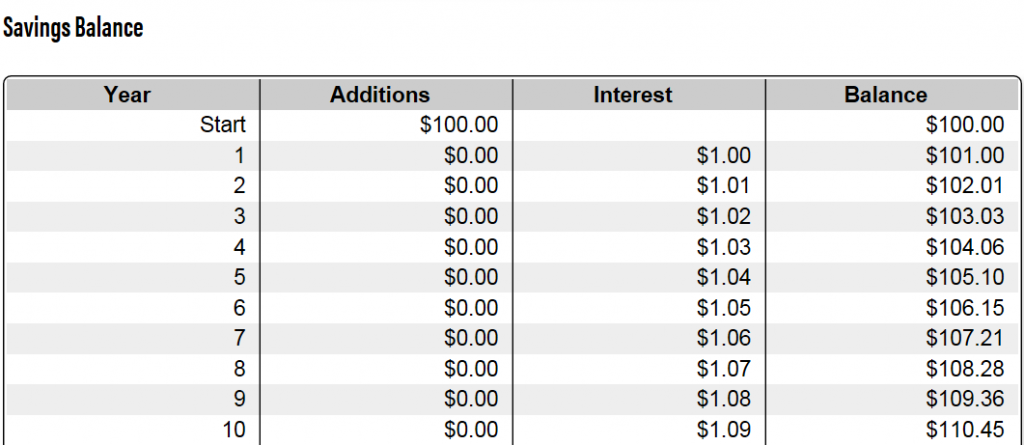

Let’s take the same $100 at 1% interest compounded annually used in the example at the end of part one of this series and use this compound interest calculator (select “View Report” to see yearly data) to calculate our savings account balance at some future points in time:

- After 10 years – annual interest = $1.09, account balance = $110.45

- After 20 years – annual interest = $1.21, account balance = $122.01

- After 30 years – annual interest = $1.33, account balance = $134.77

- After 40 years – annual interest = $1.47, account balance = $148.86

- After 50 years – annual interest = $1.63, account balance = $164.43

The total interest of just $64.43 earned on our original $100 after 50 years ($164.43 – $100.00) is not going to pay off your mortgage or even cover your future golf habit in retirement.

But you’ll notice that this is $14.43 more than the $50 we’d have if our original $100 was simply earning the same $1 every year. We’re seeing the effects of compound interest at work, albeit on a very small scale. Note how the interest earned increases every year:

Stage Two – The Impact Of Interest Rate

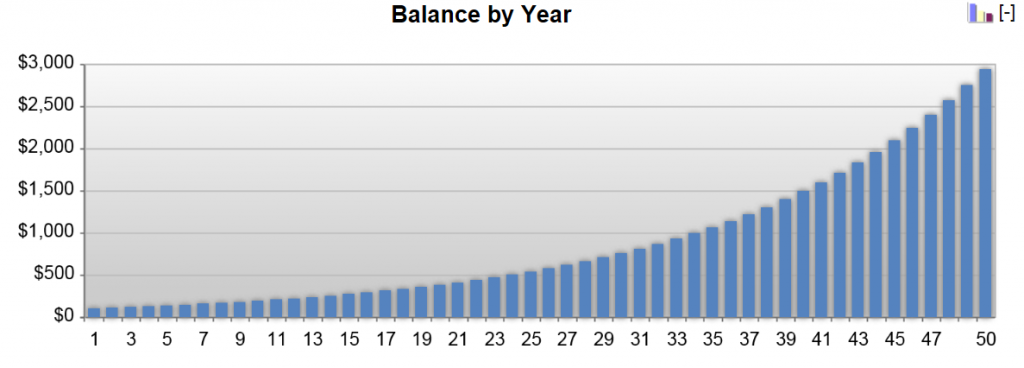

Now let’s change the interest rate from 1% to 7% in our online calculator to see what happens to the growth of that same $100 over time:

- After 10 years – annual interest = $12.83, account balance = $196.62

- After 20 years – annual interest = $25.29, account balance = $386.78

- After 30 years – annual interest = $49.80, account balance = $760.83

- After 40 years – annual interest = $97.92, account balance = $1,496.69

- After 50 years – annual interest = $192.60, account balance = $2,944.21

Our original $100 turned into nearly $3,000, an increase of nearly 30x!

Check out the growth rate of our balance – from Year 0 to Year 10, our balance grew by just $96.62 ($196.62 – $100.00). Yet from Year 40 to Year 50, the same 10-year interval, our balance grew by $1,447.52 ($2,944.21 – $1,496.69), nearly 15x as much.

This is that rocket-like acceleration that I referenced earlier at play. Take a look at how growth ramps up over time:

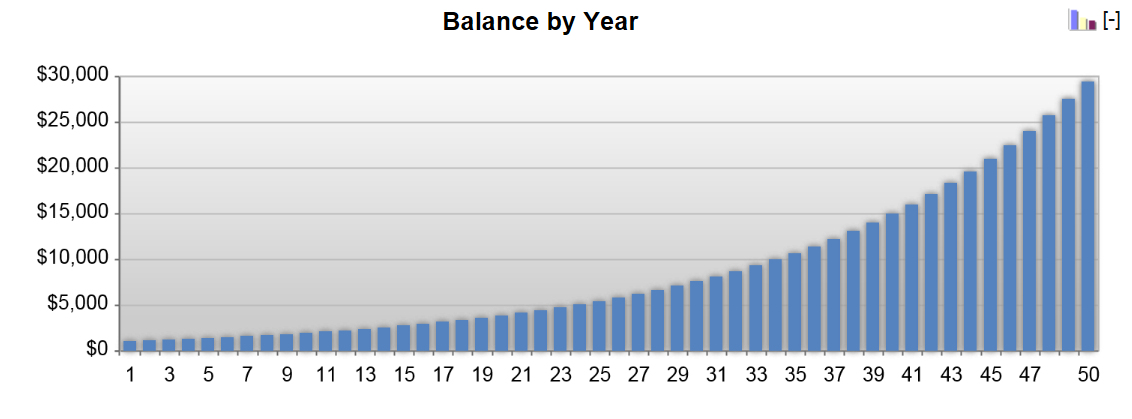

Stage Three – The Impact Of Starting Balance

Now let’s change up our last variable and substitute $1,000 for our original $100 compounding at 7% annually and see what happens:

- After 10 years – annual interest = $128.68, account balance = $1,967.11

- After 20 years – annual interest = $253.15, account balance = $3,869.53

- After 30 years – annual interest = $497.97, account balance = $7,611.86

- After 40 years – annual interest = $979.57, account balance = $14,973.83

- After 50 years – annual interest = $1,927.00, account balance = $29,455.72

Wow. Our original $1,000 grew to nearly $30,000, all on its own – without any additional effort or investment on our part whatsoever. This is the same growth rate of nearly 30x that we saw in the previous example, simply on a bigger stage due to the larger starting balance:

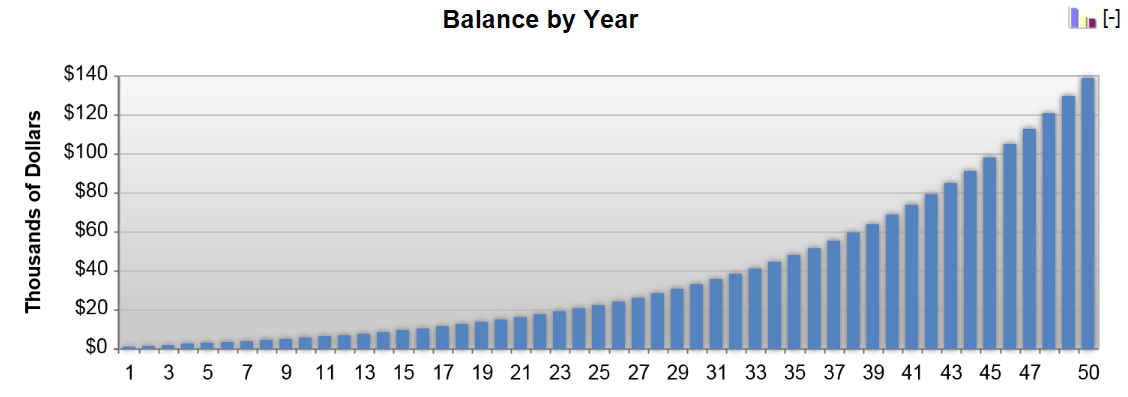

Stage Four – The Impact Of Regular Contributions

Let’s see what happens when we give compound interest a helping hand. Let’s say we take our annual tax return and make a $1,000 deposit in an account or investment returning 7% annually. But rather than let that amount sit and grow on its own, we contribute just $5 from our weekly paycheck to this same account over time:

- After 10 years – annual interest = $363.56, account balance = $5,686.15

- After 20 years – annual interest = $966.56, account balance = $14,904.43

- After 30 years – annual interest = $2,152.91, account balance = $33,038.1

- After 40 years – annual interest = $4,486.63, account balance = $68,710.09

- After 50 years – annual interest = $9,077.27, account balance = $138,882.06

Now we’re talking – Over $100K! How much of that is our own money in the form of our original $1,000 contribution plus another $5/week for 50 years? Just $14,000.

Even after subtracting this amount, the total after 50 years is still over 4x that of the previous scenario, with the only difference being the addition of small ongoing contributions.

Our ongoing contributions enabled the compounding process to accelerate even faster. This is similar to the increase in thrust which solid rocket boosters provide to a typical rocket, enabling it to more easily overcome Earth’s gravitational pull.

Breaking The Sound Millionaire Barrier

Okay, you get it. Compound interest can be a good thing. But just how good can it be, if given time to work? Try millionaire good.

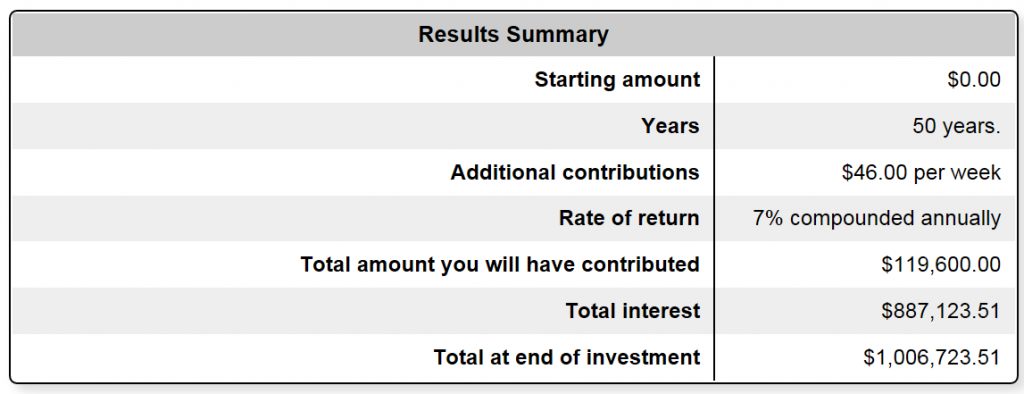

By way of illustration, let’s plug one last scenario into our handy-dandy compound interest calculator. Let’s drop our starting balance to $0, use the same 7% interest rate and 50-year time horizon, and increase our weekly contribution from $5.00 to $46.00:

- After 10 years – annual interest = $2,160.74, account balance = $34,214.88

- After 20 years – annual interest = $6,563.91, account balance = $101,520.84

- After 30 years – annual interest = $15,225.68, account balance = $233,921.72

- After 40 years – annual interest = $32,264.61, account balance = $494,374.11

- After 50 years – annual interest = $65,782.80, account balance = $1,006,723.51

Go ahead and count ’em – there’s seven digits to the left of the above decimal in our account balance after 50 years. You’re looking at a million dollars.

For a final illustration of the incredible growth made possible by compound interest, look no further than the fact that while our balance only grew by just $34,214.88 in the first 10 years, it grew by a staggering $512,349.40 in the last 10, despite the fact that we were contributing the same $46.00/week throughout both periods.

The truly celestial part? $887,123.51 or 88.7% of this million bucks is a direct result of compound interest rather than our own contributions. The proof is in the calculator pudding:

If you think that this millionaire scenario is unrealistic, consider that the inflation-adjusted average return of the U.S. stock market over the last 100 years is a little over 7% after dividend reinvestment, while the typical new high school or college grad has almost exactly 50 years to standard retirement age.

If someone offered you $887,123.51 free and clear if you could simply save $46.00/week for 50 years, would you take them up on it? This is the offer available to you via the compounding power of interest.

Launch Your Personal Rocket To Riches

Launching your personal compound interest rocket is one of the primary keys to building wealth. Here’s the countdown checklist:

1) Ignition – Making your first contribution to an interest-bearing savings or investment vehicle is the act that will ignite your engines.

2) T-Minus-Zero – The point at which the interest in your account begins compounding represents the point at which your solid rocket boosters come alive, powering a slow but steady defiance of gravity in the form of lift-off.

3) Ascent – Each compounding cycle that passes adds to the speed of your account growth. While your balance will be growing only slowly after initial lift-off, the growth of compound interest never stops accelerating. Give it enough time, and you’ll be breaking the “millionaire” barrier.

Extra Bonus – For a visual illustration of a rocket’s incredible power and acceleration, check out the below short video of NASA’s Apollo 8 Saturn V mission launch, which resulted in the first successful orbit of the moon:

Up Next – Compound Interest, Part 3: History’s Best Double Agent

Join The Conversation!