Dancing On Ice: Designing Your Cash Flow Choreography

I come from a highly competitive family. We have trophies for winners of annual board game tournaments and football pools. Engraved plaques for golf scramble champs.

It goes without saying that we also have a fondness for the Olympics – a gathering of the world’s finest athletes to compete for the right to be labeled the best on earth. It was while watching the figure skating competitions during the Winter Olympics earlier this year that I was inspired with the idea for this post.

Even a perfectly balanced budget is of little use without the proper cash flow choreography. Today we’re reviewing how to keep your monthly income and expenses in sync like a perfectly choreographed performance on the ice.

Table of Contents

The Concept Of Cash Flow

Earlier in the Master Your Money series, we borrowed the business concept of net profit and used it to define the surplus in your monthly budget. As the CFO of your household, your goal is to protect and grow the net profit of your monthly budget. But you also have another, equally important responsibility – managing your budget’s cash flow.

So what exactly is cash flow? Simply put, cash flow is a business term for inflows and outflows of cash from a given company or account. Revenue from sales is a typical inflow, while capital expenses or payroll constitute outflows.

In the world of personal finance, the concept remains the same. Paychecks or other forms of income represent inflows to your checking account. Bills, non-discretionary spending, discretionary spending, and transfers to savings all represent outflows.

Cash Flow Choreography: Timing Is Everything

Figure skating performances on the Olympic stage contain a great deal of choreography. Each and every movement on the ice is part of a carefully composed overall sequence. A poorly-choreographed performance can lead to disastrous results handed down from the judges’ table and a quick elimination.

Think of the monthly transactions in your checking account as a figure skating performance on the Olympic rink. Planning exactly when each inflow (credit) and outflow (debit) will occur is important to ensure your account stays in the black. A poorly-managed cash flow can result in your account balance dipping below zero, incurring overdraft and insufficient funds fees.

In any given month, the timing of your income in relation to that of your bill payments, spending, and transfers to savings is incredibly important. Because without the right choreography, even a budget which is perfectly balanced on paper can still put your account balance in the red and give you the headaches and stress that accompany an overdrawn account.

An Out-Of-Sync Cash Flow

Let’s use the budget of a couple we’ll call John and Amy to take a look at what I mean. John is a groundskeeper for the local college, while Amy works part-time as a clerk at the local library. Together, they net $52,000 per year after taxes. They both get paid weekly, which puts their income at $4,000 in a typical month containing four weeks.

John & Amy do a good job of living within their means, and spend only $3,500 per month on bills, non-discretionary spending, and discretionary spending. The remaining $500/month they save to build up their emergency fund. Take-home income of $4,000 – $3,500 in monthly expenses – $500 transferred to savings means they have a perfectly balanced budget.

Most folks would say this couple’s finances are in great shape. But John & Amy keep getting dinged with overdraft fees, bounced checks, and insufficient funds fees. They’re financially stressed and feel like they’re living paycheck-to-paycheck. How can this be?

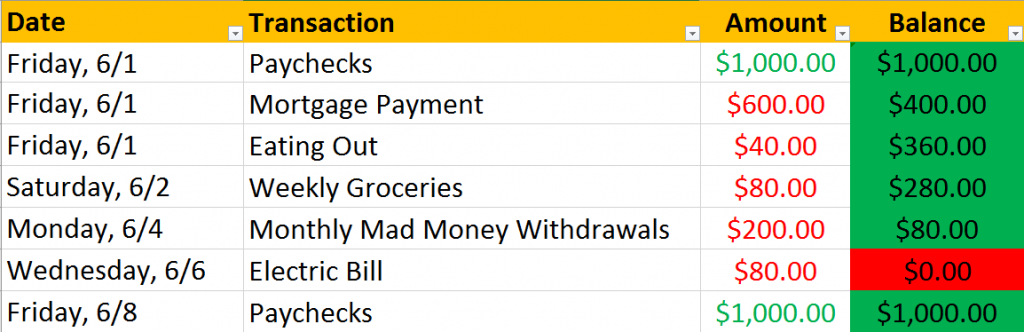

Let’s look at their budget and forecasted checking account cash flow for the first week of the month. Deposit amounts (inflows) are in green, withdrawal amounts (outflows) are in red:

Even though John & Amy have $2,000 in forecasted income over this span and only $1,000 in expenses, they have some serious cash flow problems.

After withdrawing their monthly mad money allowance on Monday, 6/4, they will have only $80 left in their account until their next paycheck. And after their Electric Bill drains their account on Wednesday, even the slightest incidental expense prior to Friday like filling up at the gas station will result in an account overdraft.

A Perfectly Choreographed Cash Flow

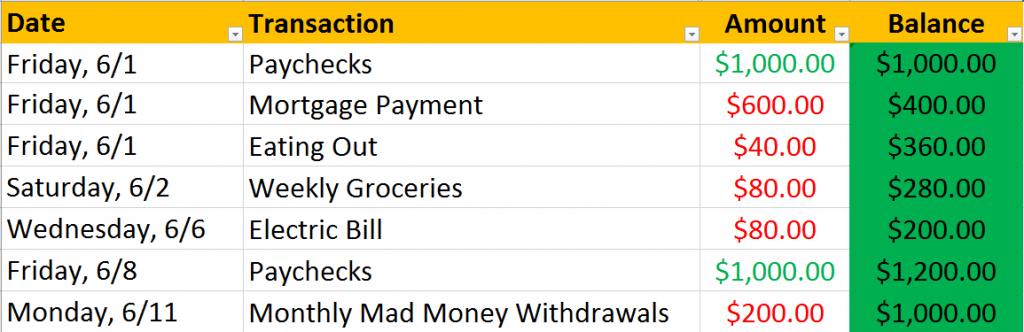

So how can John & Amy fix this? The simplest solution is to reschedule their monthly mad money allowance withdrawal from Monday, 6/4 to sometime after Friday, 6/8. Doing so puts their account back in the black (or green, as it were):

Simply by better choreographing their cash flow, John & Amy have gone from near-certain monthly overdrafts to a $200 cushion in their account that first week of the month. This should provide them with more than enough for incidental or unbudgeted expenses between Monday and Friday.

With this one simple change in their money management schedule, John & Amy should finally be able to start experiencing some of the financial freedom that their budget promises on paper.

Stop Living Paycheck-To-Paycheck

Without the proper cash flow choreography, even households with plenty of income and a perfectly balanced budget can find themselves in the same boat as the 78% of Americans employed full-time who are living paycheck-to-paycheck.

Such a lifestyle involves constant stress. The need to monitor your account balance like a hawk. Mailing a check and crossing your fingers that it won’t bounce. Wondering while standing in the checkout aisle if your debit card will be declined (again). Rushing to the bank after work to deposit your paycheck, hoping to avoid overdraft fees.

This is not only dangerous for your health, it’s the very opposite of financial freedom. And it’s no way to live.

Establish A Cash Flow Rhythm

So how exactly do you properly choreograph your monthly cash flow and break out of the uncertainty of the paycheck-to-paycheck lifestyle?

The first step is to use your budgeted income, bills, and other expenses to forecast the cash flow for your checking account in a typical month, like we did for John & Amy above.

Start by making a list of the date and amount of anticipated checking account inflows like paychecks. Do the same for expected outflows like bills, non-discretionary spending, discretionary spending, and transfers to savings.

Order the list by date, then calculate your projected account balance after each transaction and check for deficits. If any are found, reschedule transactions in your control such as non-bill related spending or transfers to savings to future points which cause no such issues.

The Bills page of your Mint account will provide you with a handy list of your bill amounts and due dates. And the Mint Budgets page will list your budgeted income, spending, and savings goal amounts.

Olympic-Caliber Cash Flow Choreography

If you have a balanced budget and a properly choreographed cash flow, you’ll no longer suffer from the stress of the unknown, overdraft fees, or insufficient funds fees. But you’ll still need to strictly adhere to your financial dance routine each month or run the risk of having your income and expenses fall out of step with one another.

This can be difficult to do month-to-month due to the changing calendar. And don’t forget holidays, which can impact paydays as well as banking availability. All told, you’ll need to be very much on point with the scheduling of your transactions. Such a system can still be somewhat stressful in its own right.

You can greatly simplify your life and achieve Olympic-caliber choreography in your cash flow by making the timing of your bills, expenses, and transfers to savings insignificant altogether in relation to your paychecks.

The secret? Start the month with enough money in your account to cover all of your budgeted outflows for the entire month. This approach eliminates the need to carefully choreograph expenses around weekly paycheck deposits. Your paychecks throughout the month won’t be needed to satisfy expenses until the following month.

For example, if John & Amy from the example above started each month with a $4,000 balance in their checking account, they wouldn’t have a care in the world regarding the timing of their individual monthly bills, expenses, or transfers to savings. They could even pay all of their bills for the entire month on the 1st if they so wanted.

The Benefits Of Staying A Month Ahead Of Your Budget

Can you imagine going an entire month without stressing over the timing of your financial transactions whatsoever? That’s what getting a step ahead of your monthly budget will do for you. Here’s a quick list of five benefits of using this approach:

- Makes the timing of your paychecks in relation to all budgeted spending inconsequential.

- Lets you pay bills when most convenient or efficient, rather than when you can afford to.

- Makes it possible to promptly withdraw monthly allowances for spending categories you’ve put on cash rations using the envelope system.

- Enables you to grocery shop more efficiently by purchasing food staples in bulk monthly rather than weekly.

- Allows you to schedule recurring monthly transfers of funds to dedicated savings accounts on a set date without worrying about not having the funds available to satisfy the transfer.

Design Your Cash Flow Choreography

Forecasting your monthly cash flow will enable you to identify and avoid preventable overdraft and insufficient funds fees. Designing and implementing your cash flow choreography for the first time will eliminate the stress of financial uncertainty.

After doing so, take your budget to the next level by getting a month ahead of your budgeted spending. This is a great use of your monthly net profit, and is a worthy savings goal in its own right. It will work wonders for your financial stress, and will give you the lift you need to stop living paycheck-to-paycheck.

Use the free worksheet and instructions below to create your very own financial dance routine. Once your cash flow choreography is in place, your new money management system will be nearly complete.

Extra Bonus – To see some well-designed and beautifully-executed choreography in action, watch this video of the moving and gold medal-winning pairs free skate performance delivered by Aljona Savchenko and Bruno Massot of Germany at the 2018 PyeongChang Winter Olympics.

Next Steps

For those of you who have been following the Master Your Money series from the beginning, below are your next steps on the path to financial freedom:

- Download the Cash Flow Choreography Worksheet above and enter your expected checking account inflows and outflows for a given month. The list should include the date and amount of each transaction.

- Use the Bills page of your Mint account to locate the amounts and due dates of your bills.

- Use the Budgets page of your Mint account to identify monthly amounts for non-bill related spending.

- Identify the ideal time for withdrawing funds for the budgeted spending categories which you have put on cash rations with the envelope system. You may need to schedule withdrawals weekly instead of monthly until you can get a month ahead of your spending.

- Identify the ideal time for scheduling monthly transfers from your checking account to each of your new dedicated savings accounts in the amounts listed in your monthly budget. This should include your sinking funds for bills and discretionary spending, as well as savings goal accounts.

- Scan for any potential deficits or shortages in your forecasted account balance and reschedule transactions as needed. Save this worksheet and re-use it monthly until you get a month ahead of your budget.

- Schedule monthly transfers from your checking account to each of your new dedicated savings accounts in the amounts listed in your monthly budget. This should include your sinking funds for bills and discretionary spending, as well as savings goal accounts.

- If you don’t yet have a one-month buffer in your checking account, scheduling recurring transfers could be problematic. Manual transfers made monthly as cash flow allows can be a hassle, but are safer. If you do opt for recurring transfers, schedule them for the end of the month to run the least risk of cash flow issues.

- If initiating recurring transfers from your checking account, consider scheduling them for no later than the 28th of the month. This accounts for February, the shortest month of the year.

- Transfers between accounts held at the same institution usually take place instantly or the same day*. Schedule recurring transfers between these accounts on the 28th without worry.

- Transfers between accounts held at different institutions usually take 3 business days* to complete.

- Consider scheduling recurring “push” transfers** from checking on the 28th***. But bear in mind that on any given month this may fall on a weekend or holiday. When this happens, recurring transfers scheduled for the 28th will be back-dated to the previous business day. This may result in checking being debited as early as the 25th due to weekends or holidays.

- Alternatively, consider scheduling recurring “pull” transfers** from savings on the 3rd of each new month***. This will debit your checking account on the 31st (or last day of the prior month) if no weekends or holidays interfere, or as early as the 28th (or 4 calendar days prior to the end of the preceding month) if they do.

- If initiating recurring transfers from your checking account, consider scheduling them for no later than the 28th of the month. This accounts for February, the shortest month of the year.

- If you already have a one-month buffer in your checking account, you can schedule recurring transfers without worry as early as the 1st of the month. But bear in mind that the 1st of any given month may fall on a weekend or holiday. When this happens, recurring transfers scheduled for the 1st will be back-dated to the previous business day. This has the potential to result in transfers made in an incorrect month.

- Transfers between accounts held at the same institution usually take place instantly or the same day*. Consider scheduling transfers between these accounts as early as the 1st without worry.

- Transfers between accounts held at different institutions usually take 3 business days* to complete.

- Consider scheduling recurring “push” transfers** from checking no earlier than the 4th***. This allows up to 3 calendar days for the transfer to work around weekends and holidays.

- Alternatively, consider scheduling recurring “pull” transfers** from savings no earlier than monthly on the 7th***. This will debit your checking account on the 4th if no weekends or holidays interfere, or as early as the 1st if they do.

- If you don’t yet have a one-month buffer in your checking account, scheduling recurring transfers could be problematic. Manual transfers made monthly as cash flow allows can be a hassle, but are safer. If you do opt for recurring transfers, schedule them for the end of the month to run the least risk of cash flow issues.

- Create a new savings goal in Mint representing one month’s budgeted expenses and re-prioritize your existing goals. In my experience, getting a step ahead of your budget relieves even more financial stress than an emergency fund.

- If you already have an emergency fund, consider using a portion of it to create your one-month spending buffer immediately. The amount you need is the total of your Spending and Goals line items on the Mint Budget Scoreboard.

*Electronic Funds Transfer Logistics

Some important points regarding the scheduling and timing of Electronic Funds Transfers (EFT). Electronic transfers between accounts held at the same bank usually take place instantly or on the same day. However, transfers between accounts held at different banks usually take 3 business days to complete.

Weekends can combine with the occasional holiday to extend electronic transfers between banks by an additional 2-3 calendar days. Total duration of these transfers can therefore range from 3-6 calendar days.

**Push & Pull EFT Types

You can initiate transfers to dedicated savings accounts from either your checking or savings account. But whether the scheduled transfer date represents the date your checking will be debited depends on which you use.

Initiating a transfer from the sending account is known as a “push” transfer. This typically debits the sending account either immediately or the next business day. The scheduled date of a push transfer made from checking does represent the date your checking account will be debited.

Initiating a transfer from the receiving account is known as a “pull” transfer. This also usually debits the sending account either immediately or the next business day. However, the scheduled date of a pull transfer made from savings doesn’t represent the date your checking account will be debited, but the date funds will arrive in your savings account.

If held at a different bank, your checking account will be debited up to 3 business days earlier. This can take as many as 6 calendar days due to weekends and holidays.

Transfers are least confusing for cash flow planning purposes if initiated from your checking account as “push” transfers. But if your bank charges fees for electronic transfers or doesn’t offer the ability to schedule recurring transfers, you may want to explore the use of “pull” transfers if your savings accounts are at a different institution.

***Disclaimer – YMMV

Information on EFT timing in this article is based on my own experience using Ally Bank, and YMMV. Specific dates provided are used for the purposes of illustration only. Always check your own bank(s) for transfer timing information as well as the presence of fees.

Join The Conversation!